cares act stimulus check tax refund

This form can be filed immediately to accelerate to refund. Securely access your individual IRS account online to view the total of your first second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

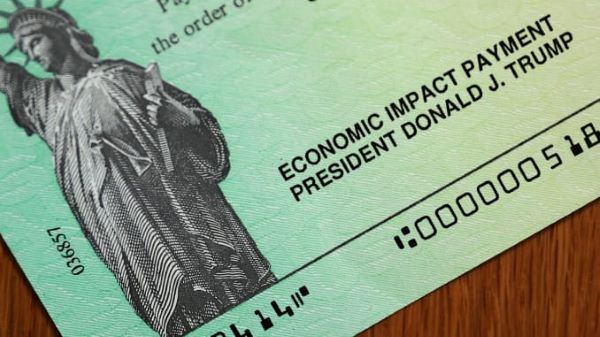

1200 in April 2020 600 in December 2020January 2021 1400 in March 2021 These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card.

. Up to 200 per day for up to 10 days if you took time off to care for someone else impacted by COVID-19. Up to 112500 if you filed as head of household. As Coronavirus COVID-19 continues to disrupt the US.

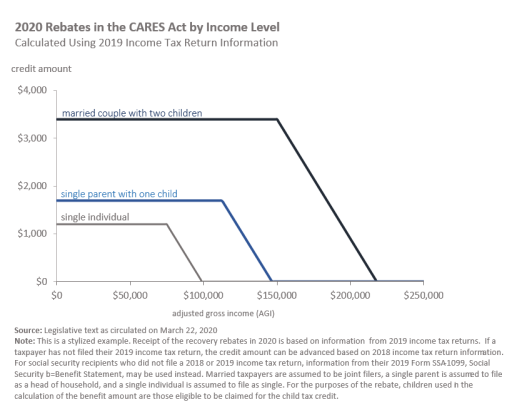

Payments were limited by 2019 or 2018 income as reported on federal income tax forms. Married filers who earn between 150000 198000 will get a reduced amount. Households will receive an additional 1400 for each dependent claimed on their most recent tax return but only if the.

Individual tax filers with adjusted gross income AGI up to 75000 will receive 1200. Single taxpayers will get 1200. Below are the income limitations for the 1200 and 2400 stimulus check.

Income and other limitations for the 1200 stimulus check. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to 1200 for individuals or 2400 for married couples. For every 100 earned over 150000 their check will be reduced by 5.

Aside from the price requirement single tax filers must make under 75000 a year and those who are married must make under 150000 to receive the full benefit. Three ways your eligibility may change for the 1400 stimulus checks Under the terms individuals could receive up to 1400 through the third stimulus checks. We mailed these notices to.

The plain and simple answer to that question is that stimulus payments are tax-free. Married taxpayers will get 2400. The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund.

The ERC can reduce the expenses that you may otherwise deduct on your federal income tax return. The Trump administration also provided an additional 600 check for most. Up to 511 per day for up to 10 days if you took time off because you were quarantined due to COVID-19 or experiencing COVID-19 symptoms.

Make sure its been at least 24 hours before you start tracking your refund or up to four weeks if you mailed your return. To help provide relief in these unprecedented times the Coronavirus Aid Relief and Economic Security Act CARES a 2 trillion stimulus package to help individuals families and businesses was signed into law. Here are exceptions to the current rules regarding.

Who would qualify. If you are entitled to a tax refund on your 2020 or 2021 taxes your entire refund will be sent to you after your taxes are filed. The simple answer is no.

Because youre getting what amounts to a refundable tax credit now in the form of a third stimulus payment rather than waiting to get the money from the credit in 2022 when you actually file your 2021 tax return youre in effect. Under the law the Fund is to be used to make payments for specified uses to States and certain local governments. You are eligible to get a stimulus check and will receive the FULL amount if you filed taxes and have an adjusted gross income of.

Economy many have turned to the federal government for hope. Go to the Get Refund Status page on. Your refund will not be reduced by any portion of the CARES Act stimulus check.

Because business owners claim it on their quarterly employment tax return Form 941 the CARES Act benefit isnt reported on their income taxes for their business. If you claimed this credit you should take note of the following. Parents also receive 500 for each qualifying child child must qualify for Child Tax Credit.

Couples who file jointly could get. Taxpayers who file head of household with an AGI under 112500 will receive a 1400 stimulus payment. The spending primarily includes 300 billion in one-time cash payments to individual people who.

College students who are claimed as dependents on their parents tax return will. Here are the numbers. The CARES Act gave a maximum 1200 per person and 500 per eligible dependent child under 17.

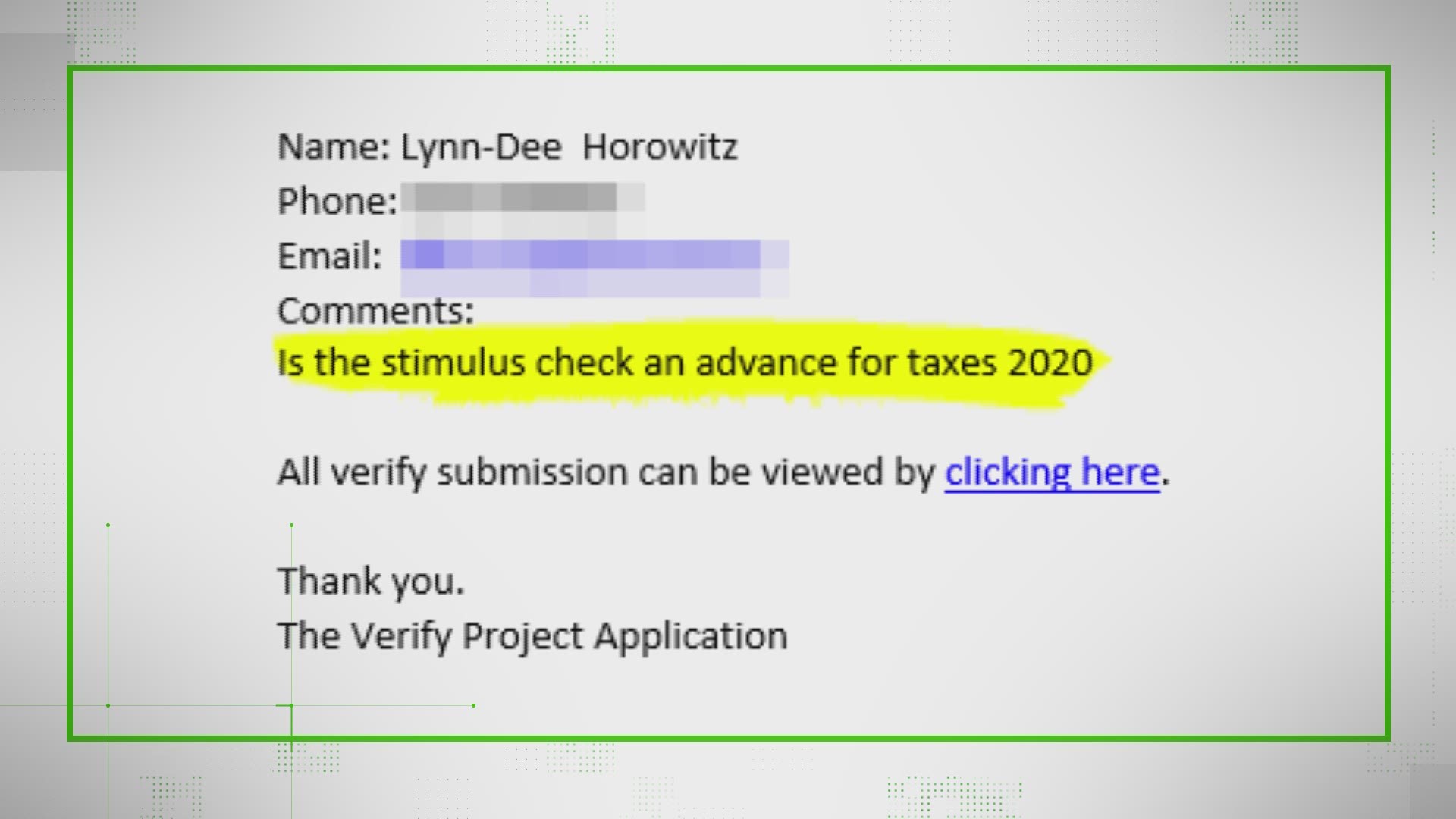

As a result of the CARES Act which became law on March 27 2020 most Americans will receive stimulus checks. If you received any stimulus check or got a direct deposit of economic impact payments EIP or through a stimulus EIP Debit card a question may hover if the payment will actually increase your tax or reduce your expected tax refunds during the year 2021. Of course there are some stipulations.

For every 100 earned over 75000 their check will be reduced by 5. Up to 75000 if single or you filed taxes married filing separately. 1 day agoThe CARES Act was passed under President Donald Trump and provided 1200 per adult and 500 per eligible dependent.

To find the amounts of your Economic Impact Payments check. The FFCRA provides refundable tax credits worth. Will the Stimulus Check Impact My Future Tax Refunds.

Rather than filing an amended 2018 return to claim the credits the CARES Act allows the taxpayer to file an application for a tentative refund quickie refund by December 31 2020 to claim its remaining MTCs for its 2018 tax year. Single filers who earn between 75000 99000 will get a reduced amount. The CARES Act allowed Americans to claim child dependents for 500 each as long as theyre 16 years old or younger that is under 17 years old.

COVID-19 Stimulus Checks for Individuals The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. The stimulus check amount is reduced by 5 for each 100 above the 75000 in AGI and completely phases out at 99000. Check out our Stimulus Check Calculator.

For example if you owed 1000 in taxes but had a refundable tax credit of 1200 youd get a 200 tax refund check from Uncle Sam. Up to 150000 if married and you filed a joint tax return. Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID disease.

Territories consisting of the. The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. The first round of stimulus checks mandated by the Coronavirus Aid Relief and Economic Security CARES Act was signed into law in March 2020.

The District of Columbia and US. Those who make. And for each child under the age of 17 parents will get 500.

Faqs On Tax Returns And The Coronavirus

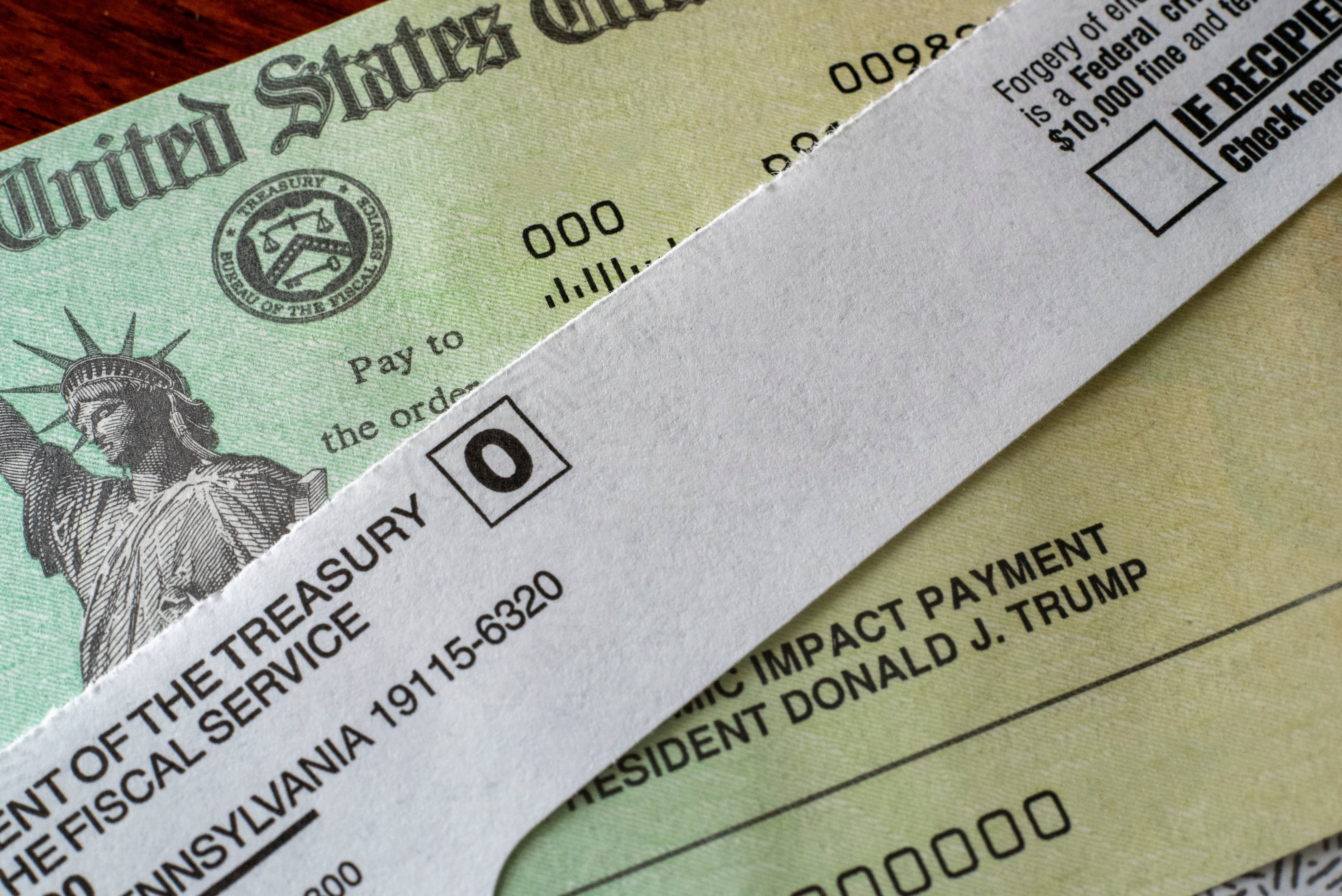

Trump Signs Covid Relief Bill 600 Stimulus Checks Go Out This Week

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Will The Stimulus Money Be Deducted From Your Refund Next Year 11alive Com

Federal Aid In 2022 No More Stimulus Checks In Sight Child Tax Credit Payments Expired Abc7 Chicago

Social Security Recipients Should Expect Stimulus Payment By April 7 Says Irs The Washington Post

Stimulus Checks And Child Support King Law

Irs Warns Of These Stimulus Check Scams After Record Number Of Reports

All You Need To Know About Round Two Of Covid Related Stimulus Checks

Stimulus Payments May Be Offset By Tax Debt The Washington Post

Did Cares Act Benefits Reach Vulnerable Americans Evidence From A National Survey

Key Dates For The Next Set Of Stimulus Payments The Washington Post

Nonresident Guide To Cares Act Stimulus Checks

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Covid 19 And Direct Payments To Individuals Summary Of The 2020 Recovery Rebates In The Cares Act As Circulated March 22 Everycrsreport Com

How To Claim A Missing Stimulus Check

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Third Stimulus Check Update How To Track 1 400 Payment Status Abc10 Com